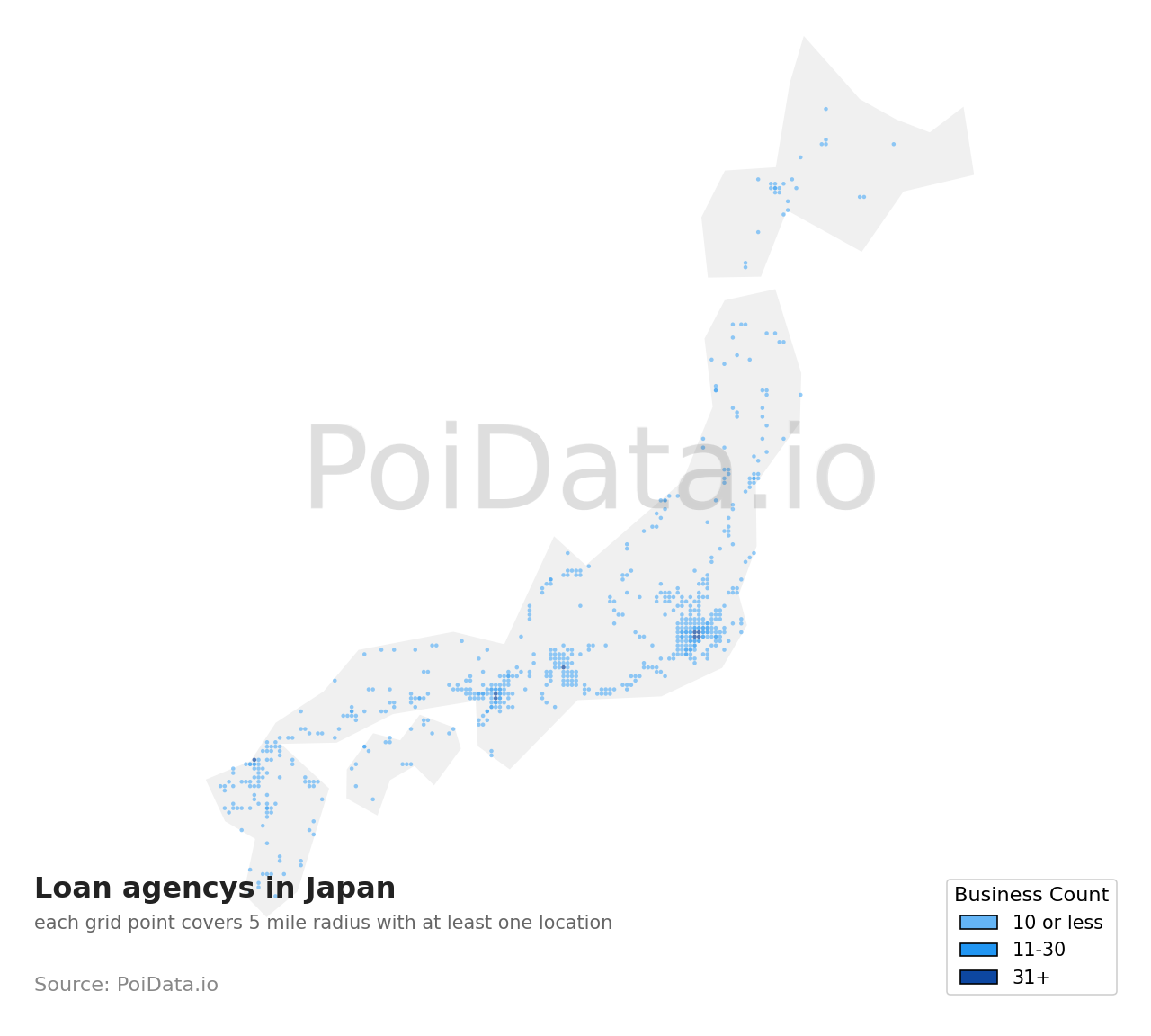

List of Loan agencies in Japan?

There are 2,900 Loan agencies in Japan as of November, 2025. The highest number of Loan agencies of Japan are in Tokyo and Osaka with 328 businesses and 238 businesses, respectively. Tokyo makes up approximately 11.3% of all Loan agencies in the Japan.

Sample Data

Preview of Loan agency businesses in Japan

| Business Name | City | Rating | Reviews | Phone | Website | Latitude | Longitude |

|---|---|---|---|---|---|---|---|

|

スリークロス 川口店

|

Kawaguchi

|

★

4.0

|

421

|

*0*8-*0*3*-9*2*9 | carsensor.net |

**.****

|

**.****

|

|

クラポ札幌東店

|

札幌市東区

|

★

4.0

|

301

|

*1*-2*9-*4*4 | curapo.com |

**.****

|

**.****

|

|

クラポ 苫小牧店 / エ...

|

Tomakomai

|

★

4.0

|

187

|

*1*4-*2-*6*6 | curapo.com |

**.****

|

**.****

|

|

クラポ土浦店 (株)C...

|

Tsuchiura

|

★

4.0

|

132

|

*2*-8*4-*2*7 | curapo.com |

**.****

|

**.****

|

|

スリークロスシンユウ...

|

Takamatsu

|

★

5.0

|

42

|

*8*-8*2-*2*2 | threecross-shikoku.c... |

**.****

|

**.****

|

|

Yamaha You Shop Tera...

|

Shinjo City

|

★

5.0

|

26

|

*2*3-*2-*9*5 | terax0920.wixsite.co... |

**.****

|

**.****

|

|

Navy Federal Credit...

|

Kitanakagusuku

|

★

4.0

|

20

|

Not available | navyfederal.org |

**.****

|

**.****

|

|

Arkstar Internationa...

|

Sakura

|

★

3.0

|

15

|

*0*8-*0*3*-7*8*4 | carsensor.net |

**.****

|

**.****

|

|

オリエントコーポレー...

|

Osaka

|

★

1.0

|

14

|

*6-*2*3-*1*0 | orico.co.jp |

**.****

|

**.****

|

|

Plus

|

Wakayama

|

★

3.0

|

12

|

*7*-4*7-*0*1 | pluswakayama.jp |

**.****

|

**.****

|

Get access to all 2,890 remaining Loan agencies with complete contact information, addresses, and business details.

Get Complete List (2,900 Businesses)Top States

Highest concentration of Loan agencies

| State | Business Count | Percentage |

|---|---|---|

| Tokyo |

328

|

11.3%

|

| Osaka |

238

|

8.2%

|

| Aichi |

135

|

4.7%

|

| Kanagawa |

131

|

4.5%

|

| Hyogo |

122

|

4.2%

|

| Saitama |

118

|

4.1%

|

| Chiba |

107

|

3.7%

|

| Fukuoka |

103

|

3.6%

|

| Hokkaido |

90

|

3.1%

|

| Shizuoka |

67

|

2.3%

|

| Hiroshima |

50

|

1.7%

|

| Ibaraki |

50

|

1.7%

|

| Kyoto |

42

|

1.4%

|

| Miyagi |

41

|

1.4%

|

| Gunma |

40

|

1.4%

|

| Tochigi |

39

|

1.3%

|

| Okinawa |

37

|

1.3%

|

| Okayama |

36

|

1.2%

|

| Kumamoto |

36

|

1.2%

|

| Niigata |

36

|

1.2%

|

| Yamaguchi |

34

|

1.2%

|

| Fukushima |

33

|

1.1%

|

| Gifu |

32

|

1.1%

|

| Mie |

26

|

0.9%

|

| Nagano |

26

|

0.9%

|

| Kagoshima |

26

|

0.9%

|

| Ehime |

23

|

0.8%

|

| Miyazaki |

22

|

0.8%

|

| Akita |

21

|

0.7%

|

| Ishikawa |

21

|

0.7%

|

| Saga |

21

|

0.7%

|

| Nagasaki |

20

|

0.7%

|

| Nara |

20

|

0.7%

|

| Shiga |

20

|

0.7%

|

| Oita |

19

|

0.7%

|

| Aomori |

17

|

0.6%

|

| Wakayama |

17

|

0.6%

|

| Fukui |

16

|

0.6%

|

| Iwate |

16

|

0.6%

|

| Toyama |

16

|

0.6%

|

| Yamanashi |

16

|

0.6%

|

| Kagawa |

16

|

0.6%

|

| Yamagata |

15

|

0.5%

|

| Kochi |

14

|

0.5%

|

| Tokushima |

9

|

0.3%

|

| Tottori |

8

|

0.3%

|

| Shimane |

7

|

0.2%

|

| Ama District, Aichi |

4

|

0.1%

|

| Nakagami District, Okinawa |

4

|

0.1%

|

| Kikuchi District, Kumamoto |

4

|

0.1%

|

Top Cities

Cities with most Loan agencies

| City | Business Count | Percentage |

|---|---|---|

|

Osaka

|

115

|

4%

|

|

Yokohama

|

50

|

1.7%

|

|

Nagoya

|

47

|

1.6%

|

|

Kobe

|

44

|

1.5%

|

|

Sapporo

|

42

|

1.4%

|

|

Fukuoka

|

40

|

1.4%

|

|

Shinjuku City

|

30

|

1%

|

|

Kyoto

|

28

|

1%

|

|

Sendai

|

25

|

0.9%

|

|

Kumamoto

|

24

|

0.8%

|

|

Hiroshima

|

22

|

0.8%

|

|

Kawasaki

|

22

|

0.8%

|

|

Minato City

|

21

|

0.7%

|

|

Niigata

|

20

|

0.7%

|

|

Okayama

|

20

|

0.7%

|

|

Saitama

|

20

|

0.7%

|

|

Himeji

|

17

|

0.6%

|

|

Sakai

|

17

|

0.6%

|

|

Chiyoda City

|

17

|

0.6%

|

|

Chiba

|

16

|

0.6%

|

|

Toshima City

|

16

|

0.6%

|

|

Kitakyushu

|

15

|

0.5%

|

|

Shizuoka

|

15

|

0.5%

|

|

Utsunomiya

|

15

|

0.5%

|

|

Ota City

|

15

|

0.5%

|

|

Kagoshima

|

14

|

0.5%

|

|

Setagaya City

|

14

|

0.5%

|

|

Kanazawa

|

13

|

0.4%

|

|

Hamamatsu

|

13

|

0.4%

|

|

Adachi City

|

13

|

0.4%

|

|

Chuo City

|

13

|

0.4%

|

|

Shibuya

|

13

|

0.4%

|

|

Takamatsu

|

12

|

0.4%

|

|

Miyazaki

|

12

|

0.4%

|

|

Edogawa City

|

12

|

0.4%

|

|

Katsushika City

|

12

|

0.4%

|

|

Matsudo

|

11

|

0.4%

|

|

Matsuyama

|

11

|

0.4%

|

|

Fukuyama

|

11

|

0.4%

|

|

Amagasaki

|

11

|

0.4%

|

|

Kochi

|

11

|

0.4%

|

|

Oita

|

11

|

0.4%

|

|

Kurashiki

|

11

|

0.4%

|

|

Higashiosaka

|

11

|

0.4%

|

|

Kawaguchi

|

11

|

0.4%

|

|

Wakayama

|

11

|

0.4%

|

|

Akita

|

10

|

0.3%

|

|

Koriyama

|

10

|

0.3%

|

|

Naha

|

10

|

0.3%

|

|

Hachioji

|

10

|

0.3%

|

What Data Do We Provide?

Our list for Loan agencies in Japan is one of the most comprehensive in the industry. As of December, 2025, we have compiled data on 2,900 verified listings.

Essential Business Details

Complete business name, full address, and operational hours for all 2,900 Loan agencies

Contact Information

Direct phone numbers, email addresses, and website URLs for Loan agencies across Japan

Customer Engagement Metrics

Average ratings, total review counts, and customer feedback data from Loan agencies in Japan

Precise Geolocation Data

Exact latitude/longitude coordinates and regional distribution across 50 states in Japan

Complete Data Fields for Loan agencies in Japan:

Each of the 2,900 Loan agencies records includes:

Business Attributes

Common features and services (10+ businesses)

payment methods

services

amenities

accessibility

business type

other

How You Can Use Loan agencies Data from Japan

Our comprehensive list of 2,900 Loan agencies in Japan empowers you to reach the right audience through multiple channels. Here are key ways this data can give you a competitive edge in the Loan agencies industry.

Geospatial Analysis & Hotspot Detection

Perform advanced spatial analysis to identify business clusters, service gaps, and market saturation patterns across 50 states in Japan using precise coordinate data from 2,900 Loan agencies.

Market Research & Competitive Analysis

Analyze trends, saturation, and competitor presence across 50 states in Japan to uncover underserved areas and high-potential markets for Loan agencies.

Lead Generation & Sales Prospecting

Find and reach Loan agencies in Japan using verified phone numbers, websites, and category filters for smarter, targeted prospecting.

Location Intelligence & Expansion Planning

Plan new Loan agencies openings or rollouts using density maps and insights from our 2,900 listings to target low-competition, high-demand zones in Japan.

AI & NLP Model Training

Train machine learning models with structured data and real user reviews from 2,900 Loan agencies for improved sentiment analysis and recommendation systems.

Real Estate & Investment Insights

Evaluate commercial potential in Japan by analyzing the distribution of Loan agencies across 50 cities and their activity trends.

Email Marketing Campaigns

Run targeted email campaigns to Loan agencies in Japan using verified email addresses for personalized outreach and improved conversion rates.

Cold Calling & Telemarketing

Use up-to-date phone numbers from our 2,900 Loan agencies database to initiate effective conversations and improve call conversion rates.

Direct Mail Marketing

Send promotional materials to Loan agencies across Japan using accurate mailing addresses for targeted delivery and higher response rates.

Social Media Outreach

Engage Loan agencies in Japan via Instagram, LinkedIn, or Facebook using curated profile data for multi-channel marketing.

Footfall & Demand Estimation

Estimate local foot traffic and demand by analyzing the concentration of Loan agencies in specific regions of Japan and their popularity metrics.

Local SEO & Digital Services

Optimize marketing strategies for Loan agencies by studying GMB listings, ratings, and categories used by top-performing competitors in Japan.

Mapping & Navigation Integration

Add Loan agencies POI data to your apps for delivery, logistics, or travel using accurate coordinates from 2,900 verified locations in Japan.

Related Categories in Japan

Explore related categories in Japan

Loan agency in Other Countries

Explore Loan agencies data across major markets worldwide

How can I download a list of Loan agencies in Japan into Excel?

You can download the complete list of 2,900 Loan agencies data as an Excel file, along with geo-coded addresses, phone numbers and open hours by contacting our sales team.